Today we live in a culture where having debt is considered to be the norm. Sometimes it’s even seen as a right of passage or the entrance into adulthood. You accumulate student loans, credit cards, and vehicle loans as you try to make it in the world. It’s unavoidable, right? Living debt-free doesn’t seem like an option.

Today we live in a culture where having debt is considered to be the norm. Sometimes it’s even seen as a right of passage or the entrance into adulthood. You accumulate student loans, credit cards, and vehicle loans as you try to make it in the world. It’s unavoidable, right? Living debt-free doesn’t seem like an option.

Well, that’s what I assumed anyway. But two years ago, shortly after the birth of my daughter and returning to work part-time as opposed to full time, my husband and I realized some financial stressors. When we sat down and looked at our spending we realized it wasn’t because we were spending money irresponsibly, it was because so much of our budget was going to paying off debt every month. But when we looked at things in detail, we weren’t really getting anywhere.

The Reality of Debt

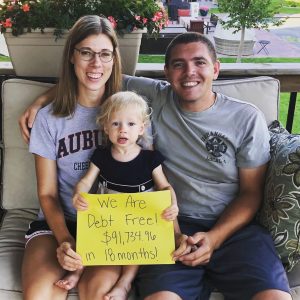

Our debt was made up of credit cards, student loans, and vehicle loans with a total right around the average for the typical American family: $91,734.96.

That number was daunting! We asked an experienced family friend for guidance. That is when we were introduced to Dave Ramsey’s, “Financial Peace University” plan. Using the Ramsey software, our friend showed us how we could pay off our debt and how much money it would save us on interest.

Seeing the numbers and the math we were ready to jump in. We listened to Dave Ramsey’s book on tape and were gifted the class.

Fast-forward 18 months later and we are debt free!

Yes, you read that correctly, we paid off $91,734.96 in 18 months, less than two years.

While this may seem like a “quick fix” by no means is it easy. It is hard, but oh so worth it.

This plan is intense and aggressive, but if followed correctly it produces results. Our lifestyle completely changed and every day we both had to make the conscious decision to stick with our plan.

We said “no” to a lot of things. My husband essentially worked two full-time jobs; I had two part-time jobs; we sold possessions, and used money we had in savings. But that is all part of the plan.

With a quick Google search you can find the 7 baby steps of the Dave Ramsey plan.

How to Become Debt Free

If you are serious about paying off your debt and changing your life I highly recommend taking Dave’s class (currently offered online, because COVID). Let me be clear at the beginning. If you want to be successful and get results like we did, you cannot do things halfway. You can’t just follow “some” of the advice; you have to do it all or it’s not worth it and it won’t work.

Set a Budget

The first thing needed is to create a zero-based budget. Let me tell you. This. Is. Scary. Every dollar in your bank account should have a job every month; there should be nothing leftover.

This doesn’t mean if you have money left over after budgeting for your needs like bills and groceries that you get to spend the rest, any extra goes to your debt. I can hear you saying now, but “what if…” don’t worry, the next step is to create an emergency fund, and Dave’s suggestion for this fund is $1,000. It doesn’t seem like a lot but keep in mind this is for true emergencies.

Create an Emergency Fund

After you have your budget and your emergency fund, next you attack your debt head-on. Listing your debts from smallest to largest by amount (not by interest rate) you will start paying off the smallest debt first while making minimum payments on the others. You throw as much money at this first debt as you can.

As you move through you will use a snowball effect taking the money you were paying on the previous debt and putting it toward the next once in addition to the minimum payment until that one is paid off. So on and so forth. During this time, you stop investing any money (including in your retirement) or saving for a college fund for your kids. All your “extra” money is going to paying off your debt. Remember you should have $0 left at the end of the month, and keep in mind, your debt does not include your home, this is an asset.

Pay Off Debt

Near the end of this step, you are making pretty big payments; toward the end of our debt journey we were making average monthly payments of $5,000. This step takes the longest but at the end of it, all your money is yours and doesn’t have to go to anyone else. Now this is really just the gist of it, there is a lot more to it. I highly recommend purchasing Dave’s books or taking the class so you can learn more details and tips and tricks.

Currently, my family is on step 3 of 7, we are working on now fully funding our emergency fund (saving a total of 3-6 months of expenses) before we start investing, saving for our daughter’s college fund, and paying off our home early.

This isn’t the norm, not having debt in today’s world isn’t common, but in this case I would rather be weird!